Employer Responsibility to Report New Employees (e-CP22)

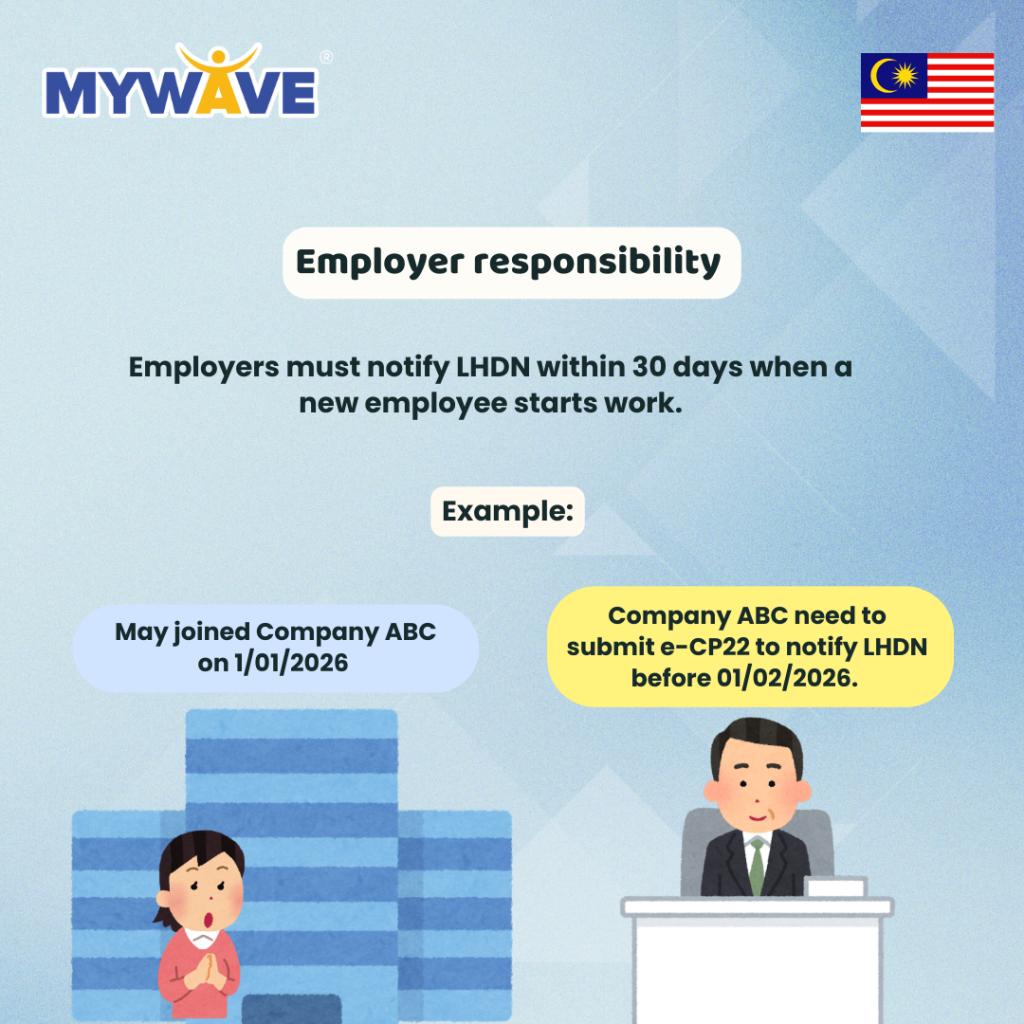

When a company hires a new employee, the employer has a legal responsibility to notify LHDN if the employee is, or is likely to be, chargeable to tax.

This notification must be made within 30 days from the date the employee starts work, using Form CP22 (Notification Form by Employer for New Employee).

e-CP22 Is Now Mandatory

Effective 1 September 2024, employers are required to submit the CP22 notification through e-CP22.

Key points employers should note:

- Manual submission of Form CP22 is no longer allowed

- All CP22 notifications must be submitted online

- e-CP22 is available via the MyTax portal

Submission Timeline Example

For example, if an employee joins on 1 January 2026, the employer must submit e-CP22 by 1 February 2026 to notify LHDN of the employment.

Failing to submit within the required timeframe may result in non-compliance.

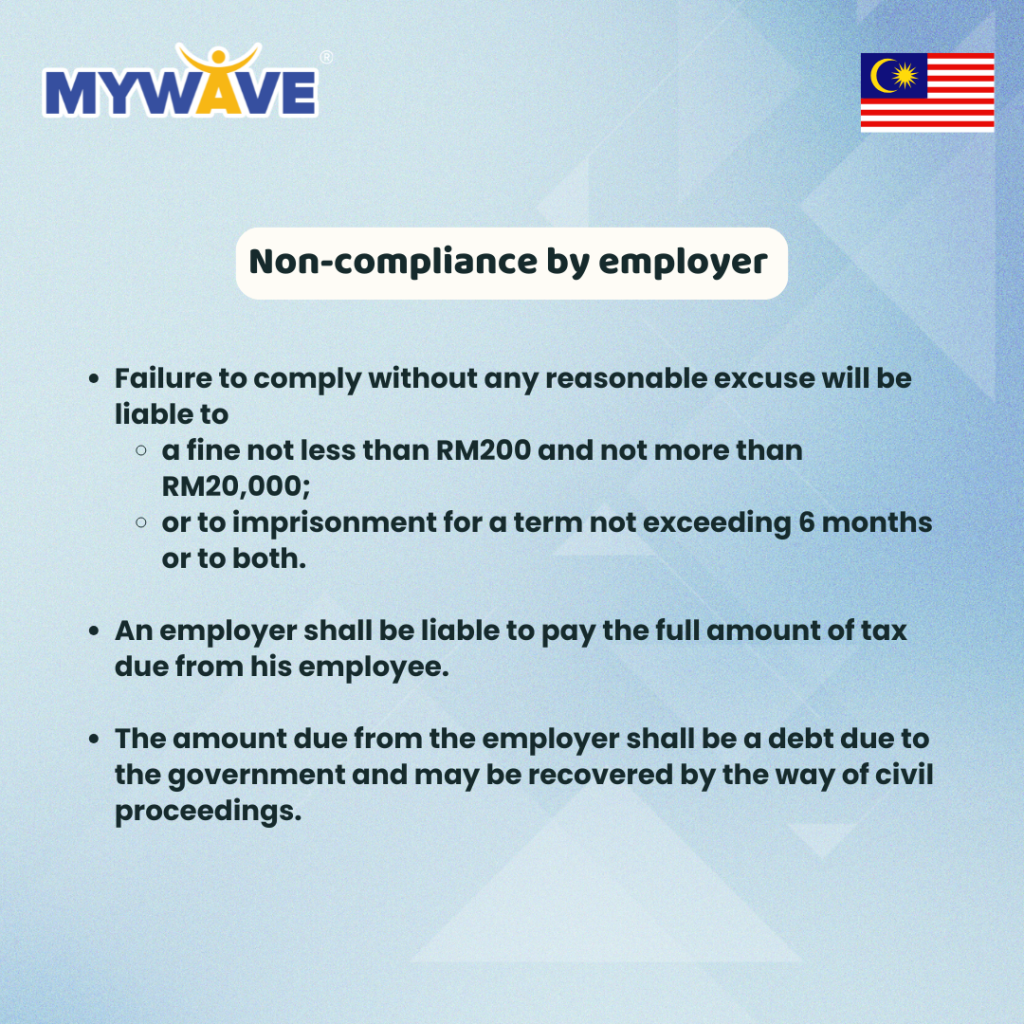

Consequences of Non-Compliance

Under subsection 83(2) of the Income Tax Act 1967, failure to comply without reasonable excuse may result in:

- Fine: RM200–RM20,000

- Imprisonment of up to 6 months

- Or both

In addition, the employer may be liable to pay the full amount of tax due from the employee.

Any amount paid by the employer is considered a debt due to the government and may be recovered through civil proceedings.

Stay on Track With Your Reporting Obligations

Timely submission of e-CP22 is an important employer responsibility and helps ensure compliance with income tax regulations.

Need Help Managing Employer Reporting Requirements?

If you need support in handling employee tax notifications and compliance matters, contact us to find out how we can assist.

Reach out to us to learn more about how we can help your business.

source: https://www.hasil.gov.my/en/employers/notifications-of-new-employee/