In Malaysia, your Tax Identification Number (TIN) is a crucial reference used for tax filings, payroll processing, and official correspondence with LHDN (HASiL). Whether you’re an employee checking your own records or an HR or payroll team assisting staff, knowing how to verify a TIN quickly can save time and prevent errors.

This guide walks you through the simple steps to check your TIN using the MyTax Portal.

What Is a Tax Identification Number (TIN)?

A TIN is a unique number issued by Lembaga Hasil Dalam Negeri (LHDN) to identify taxpayers in Malaysia. It is required for:

- Monthly payroll and PCB submissions

- Income tax filing

- Employment and HR records

- Communication with LHDN

If you’ve worked or paid taxes in Malaysia, you most likely already have a TIN.

Who Can Use the MyTax Portal to Check a TIN?

You can use the MyTax Portal if you are:

- An individual taxpayer

- An employee checking your own tax details

- An HR or payroll officer verifying employee information

Step-by-Step Guide: How to Check Your TIN on the MyTax Portal

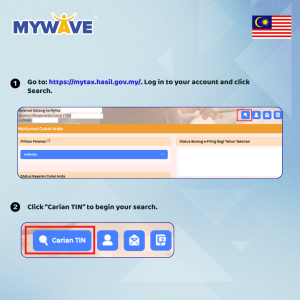

Step 1: Visit the MyTax Portal

Go to the official MyTax website: https://mytax.hasil.gov.my/. Log in to your MyTax account.

Step 2: Click on “Search”

Once logged in, locate and click the Search option on the portal.

Step 3: Select “Carian TIN”

Choose the option Carian TIN (TIN Search) to proceed.

Step 4: Choose the Relevant Group

Select the appropriate category based on the taxpayer type (for example, individual).

Step 5: Enter Identification Details

Key in the required information, such as:

- IC number

- Other requested personal details

- Ensure all details are entered accurately.

Step 6: Click “Search”

After submitting the details, click Search. Your Tax Identification Number (TIN) will be displayed below if the information matches LHDN records.

Common Tips for HR & Payroll Teams

- Always double-check IC numbers before searching

- Ensure employees’ personal details match LHDN records

- Keep TIN information confidential and secure

- Encourage employees to verify their TIN early to avoid payroll delays

Feel Free To Download These Step-by-Step Guides!

Need Help with Payroll or HR Compliance?

Managing tax, payroll, and HR processes can be complex—especially with changing regulations. If your organisation needs support with HR, payroll, or compliance-related training, MYWave is here to help.

📞 WhatsApp: +604 305 9622

📧 Email: enquiry@mywave.biz

🌐 Website: www.mywave.biz