Overtime (OT) calculation is one of the most common compliance issues faced by employers in Malaysia. Misunderstanding OT rules can lead to underpayment, employee disputes, and penalties under the law.

This guide breaks down overtime entitlement, limits, rates, and calculation methods clearly, based on the Employment Act 1955 (including the 2022 amendments).

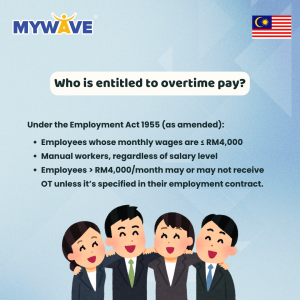

Who Is Entitled to Overtime Pay in Malaysia?

Under the Employment Act 1955:

Employees entitled to OT

- Employees earning RM4,000 or below per month

- Manual workers, regardless of salary level

These employees are legally entitled to overtime pay when they work beyond normal working hours.

Employees who may not be entitled

Employees earning above RM4,000 per month

→ Overtime entitlement depends on what is stated in their employment contract

👉 Employers should clearly state OT terms in employment contracts to avoid disputes.

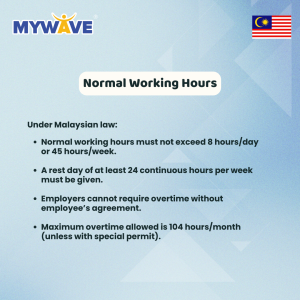

Normal Working Hours Under Malaysian Law

According to the Employment Act:

- Maximum 8 hours per day

- Maximum 45 hours per week

- At least 24 continuous hours of rest per week

- Employee consent is required before overtime can be performed

- Maximum OT allowed: 104 hours per month (unless special approval is granted)

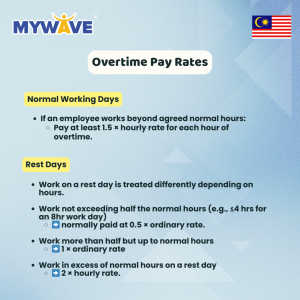

Overtime Pay Rates in Malaysia

Overtime on Normal Working Days

For work beyond normal hours: At least 1.5× the hourly rate of pay

Overtime on Rest Days

Payment depends on the duration worked:

- Work not exceeding half of normal working hours

→ 0.5× ordinary rate of pay - Work exceeding half but not more than normal working hours

→ 1× ordinary rate of pay - Work beyond normal working hours on a rest day

→ 2× hourly rate of pay

📌 Ordinary Rate of Pay (ORP) refers to daily pay, while Hourly Rate of Pay (HRP) is calculated from it.

Overtime on Public Holidays

- Work up to normal hours: 2× ordinary rate of pay

- Work beyond normal hours: 3× hourly rate of pay

💡 While interpretations may vary, the law requires no less than 3× pay for extra hours worked on public holidays.

How to Calculate Overtime Pay (Step-by-Step)

To calculate OT correctly, you need three components:

Step 1: Ordinary Rate of Pay (ORP)

ORP = Monthly Salary ÷ 26

(This is the commonly used basis unless the employer applies a more beneficial method.)

Step 2: Hourly Rate of Pay (HRP)

HRP = ORP ÷ Normal working hours per day

(Usually 8 hours)

Step 3: Overtime Pay Formula

OT Pay = HRP × OT Multiplier × OT Hours Worked

Common Overtime Mistakes Employers Make

- Paying OT to ineligible employees without contractual clarity

- Exceeding the 104-hour monthly OT limit

- Misapplying rest day or public holiday rates

- Using inconsistent salary divisors for ORP calculation

- Failing to document employee consent for overtime

These mistakes can result in non-compliance during labour audits.

Stay Compliant with Confidence

Overtime compliance isn’t just about payroll—it’s about protecting both employers and employees while staying aligned with Malaysian labour laws. At MYWave, we help businesses manage payroll, statutory compliance, and HR processes accurately and efficiently—so you can focus on growing your business with peace of mind.

📩 Need help reviewing your OT calculations or payroll process? Talk to our HR experts today.